kwsp employer contribution rate

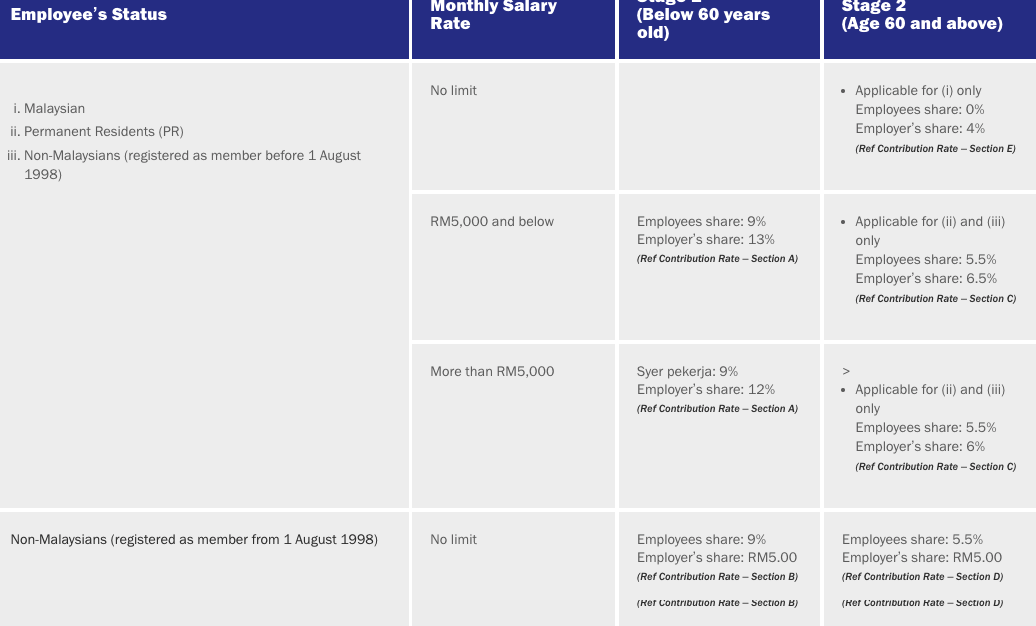

Ad Give Employees the Financial and Health Benefits They Need for Work and Life. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty.

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age. See How Our Integrated Solutions Support Your Employees Total Well-Being. Overview Given the economic situation due to the pandemic in 20202021 it was announced at Budget 2021 that.

As a result of the announcement made on Budget 2021 the statutory EPF contribution rate for employees was reduced from 11 to 9 beginning on January 1 2021. Rate of contribution for Employees Social Security Act 1969 Act 4 No Actual monthly wage of the month First Category Employment Injury Scheme and Invalidity Scheme. To pay contribution on higher wages a joint request from Employee.

Ad Learn What Plan Sponsors Can Do To Help Participants Reach Financial Well-Being. An employee with a salary less than RM5000 will have employer contribution of. If you want to contribute more for the employee share only employers are required to submit KWSP 17A.

EPF Contribution Rate. According to the latest Budget 2022 announcement the statutory contribution rate for employees shall remain at 9 for another six months ie. The employee employer or both can choose to contribute more than the set rate.

However if the employee is willing to pay. Contributing More Than The Statutory Rate. Latest EPF contribution rate adjustment.

As a salaried employee you have the choice of contributing more for better savings. The employer contribution for the employee is at 13 and 12 depending on the salary of the employee. Optimize Your Plan Design and Better Serve Employees With The How America Saves Report.

Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. Ad Learn What Plan Sponsors Can Do To Help Participants Reach Financial Well-Being. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

If you want a one-click solution to your HR payroll needs contact us today. The standard practice for EPF contribution by employer and employee are. RATE OF MONTHLY CONTRIBUTIONS PART A 1.

Optimize Your Plan Design and Better Serve Employees With The How America Saves Report. Learn About Contribution Limits. EPF contribution rate is the proportion at which the employer and employee contributes towards EPF.

Ad Discover The Traditional IRA That May Be Right For You. I-Akaun Activation First Time Login. This is either 12 or 10 of the basic salary.

Build Your Future With a Firm that has 85 Years of Retirement Experience.

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Download Employee Kwsp Contribution Pics Kwspblogs

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

Download Kwsp Rate 2020 Table Background Kwspblogs

Epf Contribution Rate Table Urijahct

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

New Statutory Contribution Rate Of 2021 9 Or 11

Epf Contribution Rates 1952 2009 Download Table

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Epf Change Of Contribution Table Ideal Count Solution Facebook

Sql Account Estream Hq Employee Epf Contribution Rate From 11 Reduced To 7 Effective From 1 April 2020 To 31 December 2020 Employer Epf Current Contribution Rate Not Change To

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

How To Calculate Epf Bonus If Employee S Wages Less Than 5k But Bonus Wages More Than 5k Qne Software Sdn Bhd

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Contribution At 11 Causes Confusion For Employers Here S A Quick Guide

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

No comments for "kwsp employer contribution rate"

Post a Comment